Nigeria : Concerns as global inflation spikes social tension

- 18 July 2022 / News / 392 / Fares RAHAHLIA

Members of Sri Lanka’s parliament will, this week, elect a new president after the dramatic toppling of the country’s president, Gotabaya Rajapaksa. Rajapaksa succumbed to a hurricane of political upheaval that saw crowds of protesters take over his presidential palace.

But the campaign for a new Sri Lanka has not stopped at its strongman’s resignation. The battleground has shifted to the roles those who have put forward themselves played in making the country in transition with a special focus on the profiling of the caretaker president and six-term Prime Minister, Ranil Wickremesinghe.

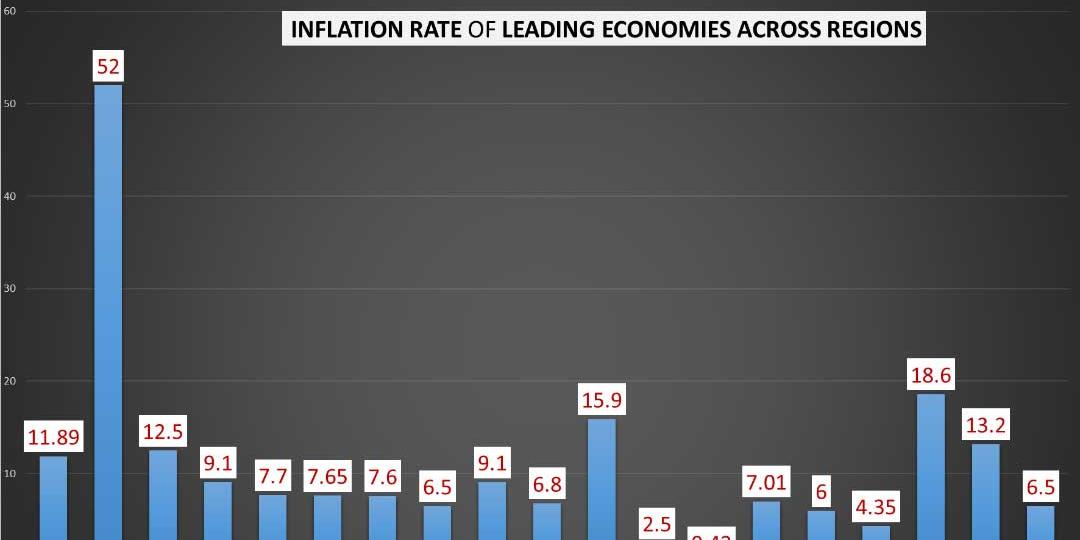

The crisis in the South Asian island is another example of a political conflict triggered by a failed economy. Central to the crisis is galloping inflation that hit 54.6 per cent in June and food inflation galloping to 80 per cent, a frightening example of the global food crisis.

Sri Lanka’s political establishment is only the most recent to fall to failing economies and, more specifically, mass anger. Recent human history is full of revolutions triggered by economic hardship and spearheaded by individuals who had exhausted their threshold of patience.

When Parisians stormed the Bastille in 1789, they were not only searching for arms, but also hunting for more grain – to make bread – a reason the protests that triggered the French Revolution were termed the Flour War.

The crisis was caused by a plethora of social upheavals and grievances more complicated than the price of bread. Yet, the bread shortage played a major role in spreading the crisis and forming its severity.

For about one and half centuries, Spain was brought to its knees by the Price Revolution. The inflation rate was between one and 1.5 per cent, extremely low compared to modern data, but considered unacceptably high because of the monetary policy in place in the 16th century. Those price ‘surges’ were significant enough to trigger a series of economic events to alter the cause of history in Europe.

From Europe across the Pacific to sub-Saharan Africa (SSA), price crises have come with chains of reactions, leaving indelible marks on humanity. But today, the entire globe is on the cusp of a widespread crisis over the unbearable rising cost of living.

Back to back, the Federal Open Market Committee (FOMC) – the interest rate fixing arm of the Federal Reserve System – has raised the benchmark rate three times this year. Yet, the inflation rate remains unperturbed printing new highs every month and surging to a region not seen in the past four decades.

In June, they gained more points again and surpassed nine per cent. There are suppositions that the cure is plateauing but the bullish job market says otherwise. In the same month, the labour market added over 370,000 jobs, surpassing experts’ projections.

The United Kingdom’s socio-economic system is a lot different from the more dynamic U.S. But they currently share a common trait in inflation growth. Both economies are currently battling to stem an inflation rate that has reached 9.1 per cent.

Starting from last year, residents, whose real incomes have badly plummeted, have called on the government to find a creative way to freeze prices to give workers leverage. Boris Johnson’s resignation has not calmed the protests.

Rather, in the race for the Prime Ministerial position, inflation, which is expected to peak at 11 per cent in the year, has become a major talking point. The Bank of England has raised the lending rate from near zero to 1.25 per cent in a fruitless effort to cool rising prices.

While the rest of the globe plays up the role of higher interest rates in combating inflation, the Eurozone is only hoping to exit negative interest rates by the third quarter of the year, according to the European Central Bank (ECB) President, Christine Lagarde. But the area is paying for its lethargy with an extremely volatile Euro. Last week saw the weakest trading value in its history with the U.S closing gap with it as it continues its free fall.

Driven by a usual energy crisis, the inflation rate of the 19-member economic bloc jumped from 8.1 per cent to 8.6 per cent in June. The European Union (EU) is in the midst of an ongoing energy crisis sparked by the war in Ukraine and associated Western sanctions against Russia. Energy prices have soared by about 40 per cent from a year ago as the EU struggles to wean itself off the Russian supply.

Inflation in Asian countries is still far behind that of the U.S. and Europe. For instance, China’s consumer price index (CPI) was 2.5 per cent higher than it was a year earlier. At almost a percentage lower than the global average inflation rate estimated at 3.42 per cent, the price change is considered normal. But for the Chinese, a two-year high inflation growth is not close to normal.

Like China, inflation had not been a concern in Japan historically. Rather, low growth and deflation were major concerns after the end of its economic miracle. From 2010 to 2020, inflation in Japan averaged roughly 0.42 per cent. And like China, the country saw its inflation spike to 2.5 per cent in May, slightly above the two per cent target of the Bank of Japan.

In that region. A more serious concern is brewing in South Korea where the inflation rate has hit a 24-year high at a six per cent year-on-year (YoY) growth. South Koreans are facing broad-based price challenges but energy costs, as in Europe, are the most overwhelming. In response, the Bank of Korea has raised its key interest rate six times since August, pushing it to 2.25 per cent.

African economies are used to elevated inflation but the new trends are raising social tensions with the World Bank and the International Monetary Bank (IMF) considering it a growth setback.

For one, Zimbabwe has had its abnormal inflation growth shot from 66 per cent to 191 per cent since the start of the Russia-Ukraine war. In 2008-2009, its hyperinflation reached 500 billion per cent, according to the International Monetary Fund. Then, 100 trillion Zimbabwean dollar banknotes were not enough to buy basic groceries.

In June, the inflation rate in Ethiopia dropped for the first time in four months. But at 34 per cent, it is no less a worrisome figure trend for the poor citizens of the East African country. Amid talk with the IMF for a bailout, headline inflation in Ghana accelerated to 29.8 per cent in June. The West African citizens have joined their counterparts in Sri Lanka, Albania, Argentina, Panama and Kenya to demand urgent actions from politicians as the cost of living reaches a breaking point across the globe.

Back home, the inflation rate reached 18.6 per cent in June. But experts say the figures do not reflect the market realities and that they are doctored to keep political tension under control. Nigeria’s inflation worry, unlike others, is as old as the economy while the citizens have managed to live with it.

But with inflation-triggered social tension growing across the world, it is difficult to speculate how Nigerians would continue to respond to the challenges and how long it will take before such protests hit home.

source: guardian.ng

English

English

français

français

العربية

العربية